Wood Group sells Ethos stake to private equity

Thu, 02 Jan 2025 | DIVISION SALE

Scottish engineering group Wood has completed the sale of its stake in Aberdeen-based EthosEnergy to private equity firm One Equity Partners.

The deal for Aberdeen-based EthosEnergy is worth $138 million (£111 million) and was first announced by the London Stock Exchange listed John Wood Group in August 2024. It was officially completed on New Year’s Eve.

Wood Group owned 51 per cent of EthosEnergy, a joint venture set up in 2014 with German industrial giant Siemens.

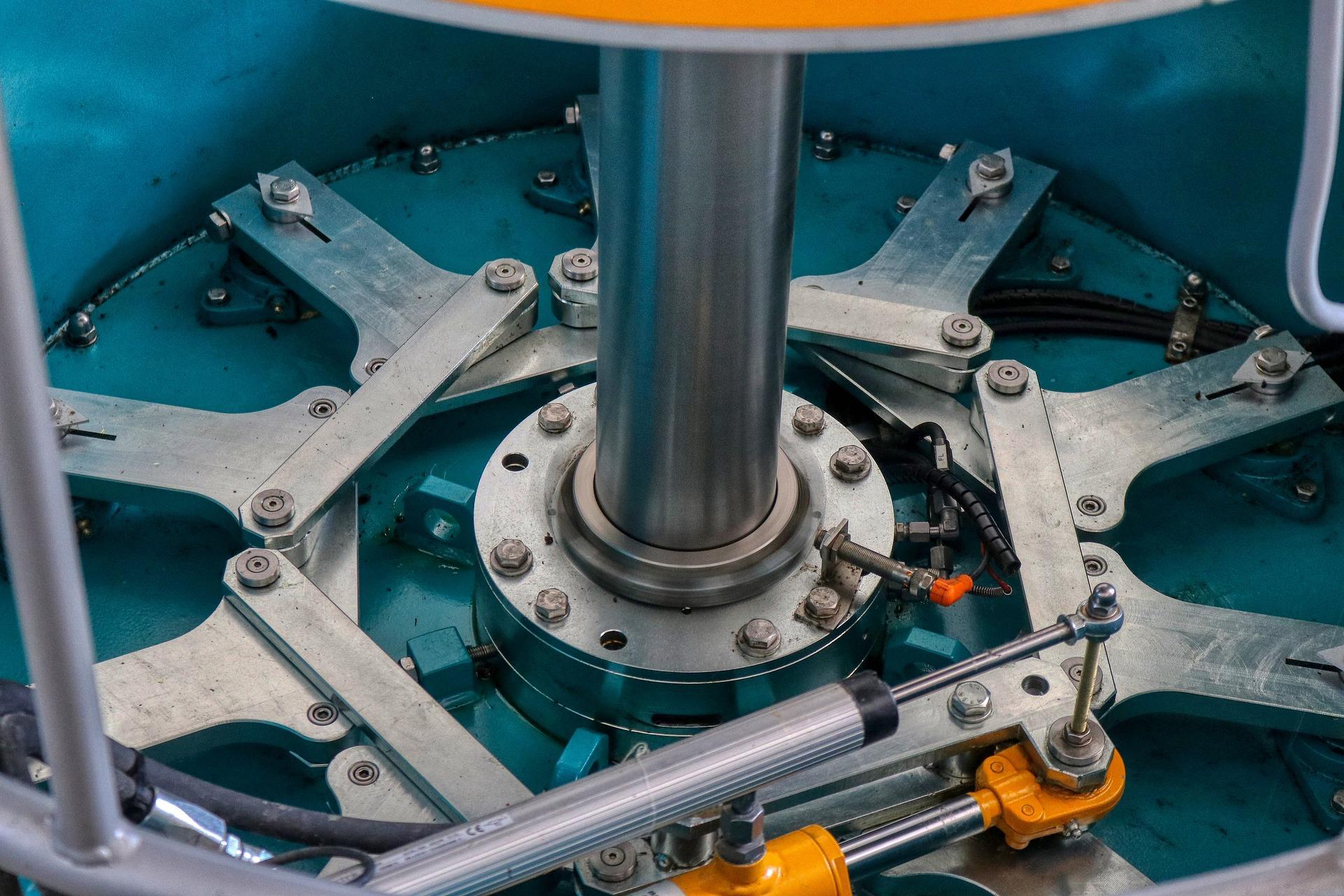

Ethos, which was part of Wood's Investment Services business unit, makes turbines and other rotating equipment such as steam turbines, heavy gas turbines, generators, transformers and compressors. Its work covers a range of sectors such as industrial, oil & gas, aerospace and power generation.

Its clients and partners include Toshiba, Sacramento Municipal Utility and Repsol Resources.

It employs around 3,600 staff globally and operates in over 100 countries. It contributed $34 million of adjusted EBITDA to Wood’s results in 2023.

Ken Gilmartin, CEO of Wood, said: "We are pleased to complete the sale of EthosEnergy to One Equity Partners. This strategic divestment is part of our strategy to be selective and focused on our core business. We will continue to align our portfolio as part of our commitment to simplify Wood."

One Equity Partners is a middle market private equity firm focused on the industrial, healthcare, and technology sectors in North America and Europe. Since 2001, the firm has completed more than 400 transactions worldwide. It has offices in New York, Chicago, Frankfurt and Amsterdam.

At the time of the announcement in August, Ante Kusurin, partner at One Equity Partners said that EthosEnergy was ‘uniquely positioned to meet the growing maintenance needs of an aging turbine fleet’.

It was also benefiting from trends such as emerging market growth, adoption of electric vehicles, electrification of heat and other industrial functions, increasing data centre demand, and a growing share of ‘intermittent’ renewable capacity that relies on dispatchable gas power to stabilise the grid.

Find out more about overseas private equity appetite for UK firms

Share this article

Latest Manufacturing Businesses for Sale

Furniture Manufacturer and Retailer

Yorkshire and the Humber, UK

This sale comprises two businesses; a furniture maker and a distributor of European-sourced furniture. Together, they enjoy great success selling to B2B markets and there are many opportunities to increase their ranges, audiences and profits.

Manufacturer and Retailer of a Wide Collection of Blinds

UK Wide

Experienced and trusted manufacturer and retailer of diverse ranges of made-to-measure blinds to a loyal domestic and commercial customer base. Gently trading throughout its history the company consistently receives many inquiries due to its strong r...

Highly Regarded Ink Manufacturer and Developer

UK Wide

Esteemed ink manufacturer and developer supplying a range of ink options to a long-term and repeat global client base predominantly in the printing packaging and currency printing industries. Operating with its own research and development laboratory...

News Search

Latest News

|

04

|

|

Mar

|

Phenna makes fourth acquisition of 2025 with Calibre deal | BUSINESS SALE

Nottingham-based Phenna Group has made its fourth acquisitio...

|

03

|

|

Mar

|

Everest Pharmacy snaps up five more pharmacies from peer Sykes | DIVISION SALE

Manchester-based Everest Pharmacy has bought five pharmacies...

|

03

|

|

Mar

|

Haulage firm Swiftcare UK sold in pre-pack deal | BUSINESS SALE

Haulage company Swiftcare UK has been sold in a pre-pack adm...

Related News

|

04

|

|

Dec

|

Victorian era engineers Cross and Morse in management buy-in | MBO/MBI

A Victorian era engineering company has been acquired throug...

|

31

|

|

Jan

|

Capita hits divestment target with £111m Trustmarque sale, but targets further disposals | BUSINESS SALE

Outsourcing and professional services firm Capita PLC has an...

|

30

|

|

May

|

Proposed sale of Amec oil and gas to make way for merger | MERGER

Wood Group has put the majority of Amec Foster Wheeler'...

Want access to the latest businesses for sale?

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

- Comprehensive range of businesses for sale

- Make direct contact with business sellers or their intermediaries

- Access to all UK administrations, liquidations and winding-up petitions

- Daily email alerts for the latest businesses for sale & distressed notifications

- Business Sale Report publication posted to you every month

- Advertise your acquisition requirements on our "business wanted" section

All this and much more, including the latest M&A news and exclusive resources