NewRiver REIT completes £222.3m sale of community pubs business

Mon, 26 Jul 2021 | BUSINESS SALE

NewRiver REIT has agreed to sell its community pub business Hawthorn Leisure to Admiral Taverns for £222.3 million. The deal represents slightly over a 16x multiple of Hawthorn’s most recently reported revenue of £13.8 million for the year ending March 2020.

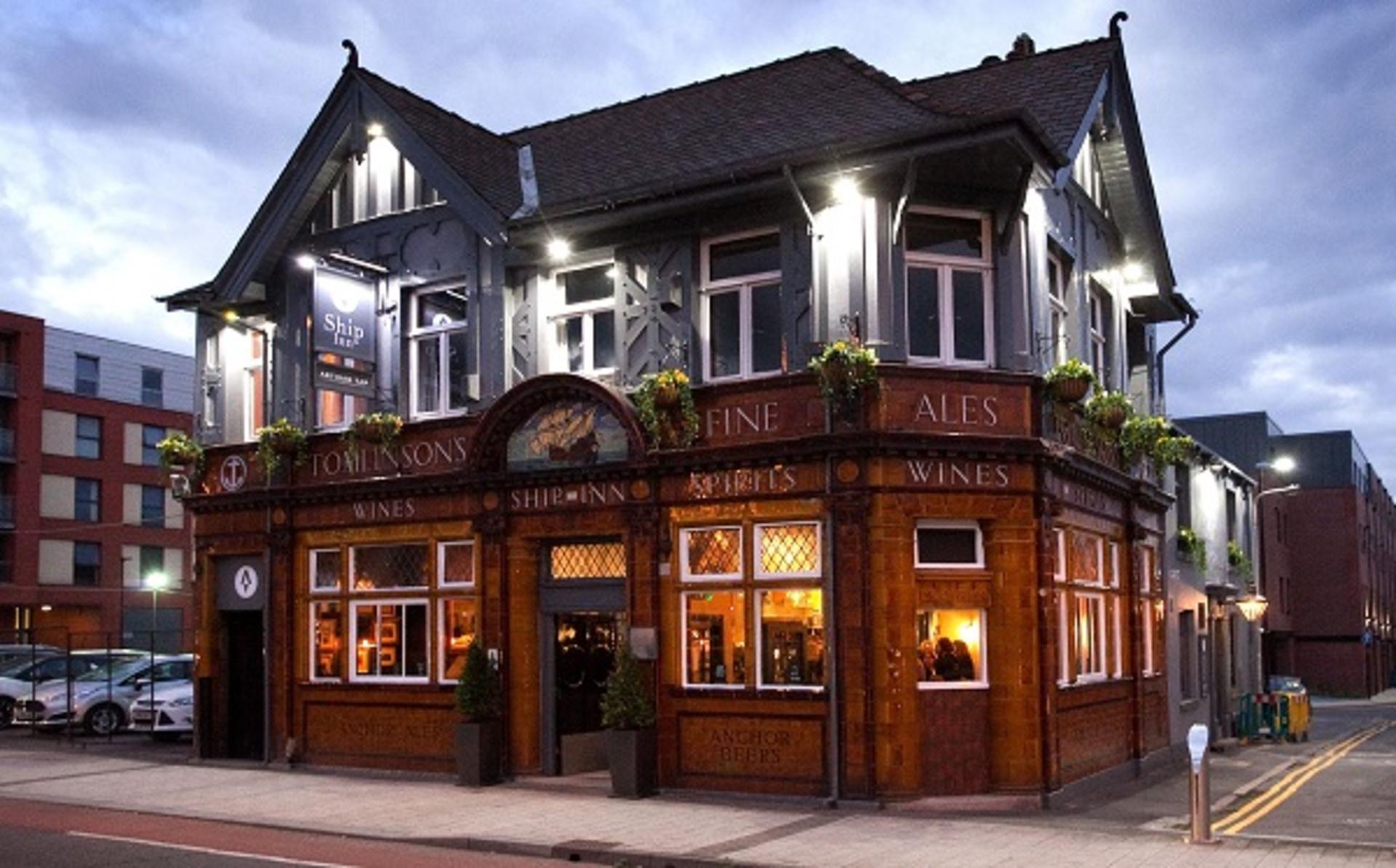

Hawthorn Leisure’s estate totals 674 leased and tenanted and operator-managed pubs. NewRiver, which first announced plans to sell the business in April, will use the proceeds from the sale to strengthen its balance sheet, help cut its loan-to-value ratio to under 40 per cent and refocus its portfolio.

The acquisition takes Chester-headquartered Admiral Taverns’ portfolio of pubs to around 1,500 and forms part of its plans to grow its community pub footprint. The deal comes at a time of booming deal-making in the UK pub sector. Pub group Punch, which acquired Ram Pub Company from Young’s earlier this month, was also reported to be interested in Hawthorn.

Admiral Taverns Chief Executive Chris Jowsey said: “This is one of the biggest acquisitions by Admiral to date and delivers on our strategy to build our estate to 1,500 sustainable pubs. It is a really exciting step forward for the business and we remain committed to the supportive partnership model, which is highly regarded by licensees.”

"Our wet-led, community focused, supportive culture is very much shared by Hawthorn and I'd like to take this opportunity to welcome our new licensees and colleagues to Admiral. The acquisition has allowed us to acquire an excellent portfolio of pubs which we look forward to developing through our award-winning and highly supportive approach."

NewRiver Chief Executive Allan Lockhart added: Over recent years, we have grown Hawthorn to become the UK’s leading community and wet-led pub business. As a consequence of this, we received significant interest from a range of potential buyers for Hawthorn, following the divestment plan we announced in April 2021.”

“We have now agreed the sale of Hawthorn which, once completed, will deliver on our key priority to reset loan-to-value, strengthening our balance sheet and enabling us to focus on executing our resilient retail strategy.”

The sale is expected to complete in August, once shareholder approval has been gained at NewRiver’s general meeting.

Find businesses for sale here.

If you are looking for an exit, we can help!

Share this article

Latest Cafes, Restaurants & Pubs Businesses for Sale

Multi-Site Burger and Fries

West Sussex, South East, UK

A long-established business specialised in selling quality burger and fries. Their offer appeals to a wide variety of customers across demographics and has resulted in a loyal clientele and repeat business. After achieving considerable success after...

LEASEHOLD

Burger Restaurant and Takeaway

Holmfirth, Yorkshire and the Humber, UK

Bringing to market this immaculately presented, independent, award winning restaurant. Clients established the business in 2019 and have built up a fantastic reputation with loyal customer base.

LEASEHOLD

Renown Restaurant

Bradford, Yorkshire and the Humber, UK

A wonderful opportunity to acquire this long established and well respected restaurant which was started by our clients in 2015, during which time it has built a strong reputation with a loyal customer following. The premises occupy a prime trading p...

LEASEHOLD

News Search

Latest News

|

24

|

|

Jan

|

Barnfield Construction moves to employee ownership | BUSINESS SALE

A 50-year-old construction firm has transitioned to employee...

|

24

|

|

Jan

|

Army supplier BCB gunning for growth after Wescom Group deal | BUSINESS SALE

A 160-year-old business which started life providing cough m...

|

24

|

|

Jan

|

Facilities management firm Atlas FM transitions to employee ownership | BUSINESS SALE

Facilities management firm Atlas FM has transitioned to empl...

Related News

|

30

|

|

May

|

Community pub group acquires portfolio of 37 sites | COMMERCIAL PROPERTY

Private equity-owned community pub group Admiral Taverns has...

|

05

|

|

Mar

|

Hawthorn Leisure pub chain up for sale | BUSINESS SALE

Hawthorn Leisure, a firm led by co-founder CEO Gerry Carroll...

|

16

|

|

Aug

|

Admiral Taverns puts eight pubs onto the market | BUSINESS SALE

Pub giant Admiral Taverns is selling off eight of its pubs i...

Want access to the latest businesses for sale?

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

- Comprehensive range of businesses for sale

- Make direct contact with business sellers or their intermediaries

- Access to all UK administrations, liquidations and winding-up petitions

- Daily email alerts for the latest businesses for sale & distressed notifications

- Business Sale Report publication posted to you every month

- Advertise your acquisition requirements on our "business wanted" section

All this and much more, including the latest M&A news and exclusive resources