Chromatography provider acquired in PE-backed deal

Wed, 26 Jun 2024 | BUSINESS SALE

Nottingham-based chromatography provider Reach Separations has been acquired by Cardiff-headquartered CatSci in a deal supported by private equity manager Keensight Capital. The deal is described as a significant milestone for CatSci, an innovation partner for medicines development, as it continues to enhance its CMC (Chemistry, Manufacturing and Controls) offering.

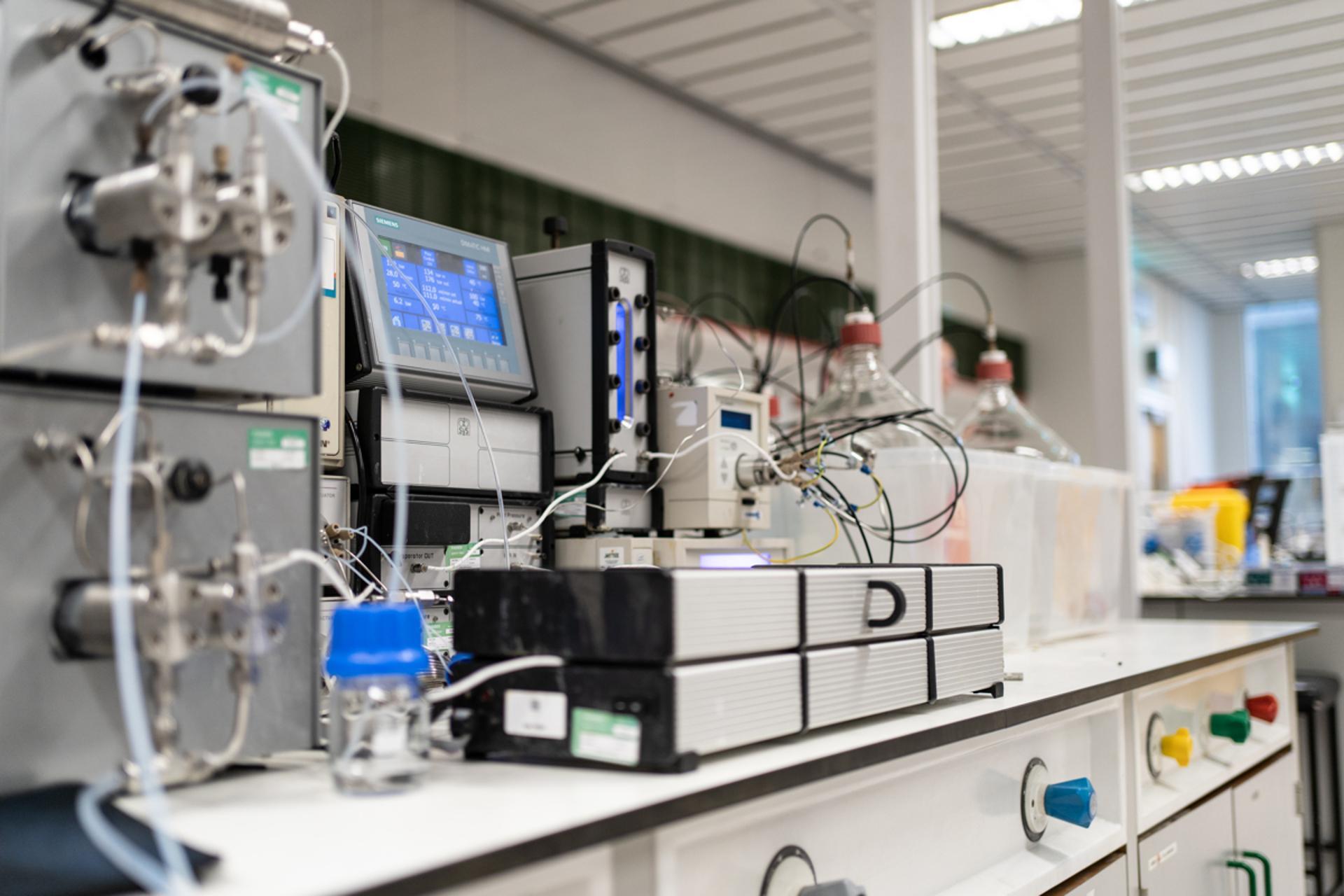

Reach Separations, which has laboratories in the UK and France, specialises in providing chromatography for the analysis and purification of chiral and achiral therapeutics. The acquisition is effective immediately and will enable CatSci to provide global customers with access to holistic chromatographic services that can be used throughout their processes, from discovery to manufacture.

CatSci Chief Executive Dr Ross Burn commented: “The need for solving complex analytical problems while meeting the ever-evolving regulatory demands is growing alongside the development of new modalities, such as oligonucleotides, TACs (Targeting Chimeras), and glues.”

"Joining forces with Reach gives our customers access to end-to-end coverage of the analytical development lifecycle, taking them from discovery through to GMP manufacture, and ultimately enabling them to help patients in need.’"

Reach Separations Business Development Director Peter Ridgway said that joining the CatSci group would “enhance and strengthen [the company’s] ability to deliver excellence in chromatography.”

He continued: “Integrating our technologies and expertise across the discovery and development landscape will provide a one-stop-shop for analysis and purification, giving the client a variety of options to progress the journey of their asset.”

Keensight Capital partner James Mitchell said that the firm would continue to support CatSci Group during their next phase of growth.

Mitchell added: "Having identified CatSci as a company with exceptional potential, unique positioning and strong expertise in the small molecule R&D, we believe that the addition of Reach’s differentiated offering, analytical capabilities and strong employee base will ensure that the combined company is well positioned for future growth in this space."

Discover how companies can attract private equity backing for their acquisitive growth plans

Share this article

Latest Medical Businesses for Sale

Residential Care Home

East Midlands, UK

Offering for sale a converted and extended residential care home in a East Midlands town. The care home has close to 40 effective beds with 15 having ensuite facilities.

Highly Profitable Care Group

UK Wide

Offering for sale an established care group of residential and nursing homes, conveniently clustered in the central and northern regions.

Living Facility Group

East Midlands, UK

A group of elderly care homes conveniently clustered in the East Midlands. The award winning management run businesses are highly profitable and well presented.

FREEHOLD

News Search

Latest News

|

24

|

|

Jan

|

Barnfield Construction moves to employee ownership | BUSINESS SALE

A 50-year-old construction firm has transitioned to employee...

|

24

|

|

Jan

|

Army supplier BCB gunning for growth after Wescom Group deal | BUSINESS SALE

A 160-year-old business which started life providing cough m...

|

24

|

|

Jan

|

Facilities management firm Atlas FM transitions to employee ownership | BUSINESS SALE

Facilities management firm Atlas FM has transitioned to empl...

Want access to the latest businesses for sale?

Business Sale Report is the complete resource for finding genuine acquisition opportunities.

Join today to receive:

- Comprehensive range of businesses for sale

- Make direct contact with business sellers or their intermediaries

- Access to all UK administrations, liquidations and winding-up petitions

- Daily email alerts for the latest businesses for sale & distressed notifications

- Business Sale Report publication posted to you every month

- Advertise your acquisition requirements on our "business wanted" section

All this and much more, including the latest M&A news and exclusive resources