Small business acquisitions in the UK - dental industry snapshot

Whilst it is true that many sellers of micro and small UK companies have unreasonable value expectations, and it is also true that there is a growing contingent of business 'buyers' with little money of their own nor experience in the industry in which they are pursuing acquisitions, it is also the case that many thousands of micro and small businesses are sold every year at or above asking price.

There are many factors that impact whether a business and its owner are ready for a successful exit, and we have delved into the ‘intra-factors’ on numerous occasions, that is, looking at the characteristics of the company itself, its position within its industry and the owner’s circumstances.On a macro level there are particular sectors where the percentage of sales of businesses that are brought to market are much higher than for other sectors. Often it is because the high level of required domain expertise and professionalism affords greater gross margins, operating metrics are easily determined and there is a sizeable universe of geographically-dispersed players.

One such sector is the UK dental industry. [Sources for facts and figures are listed at the bottom of this article].

How big is the UK dental market?

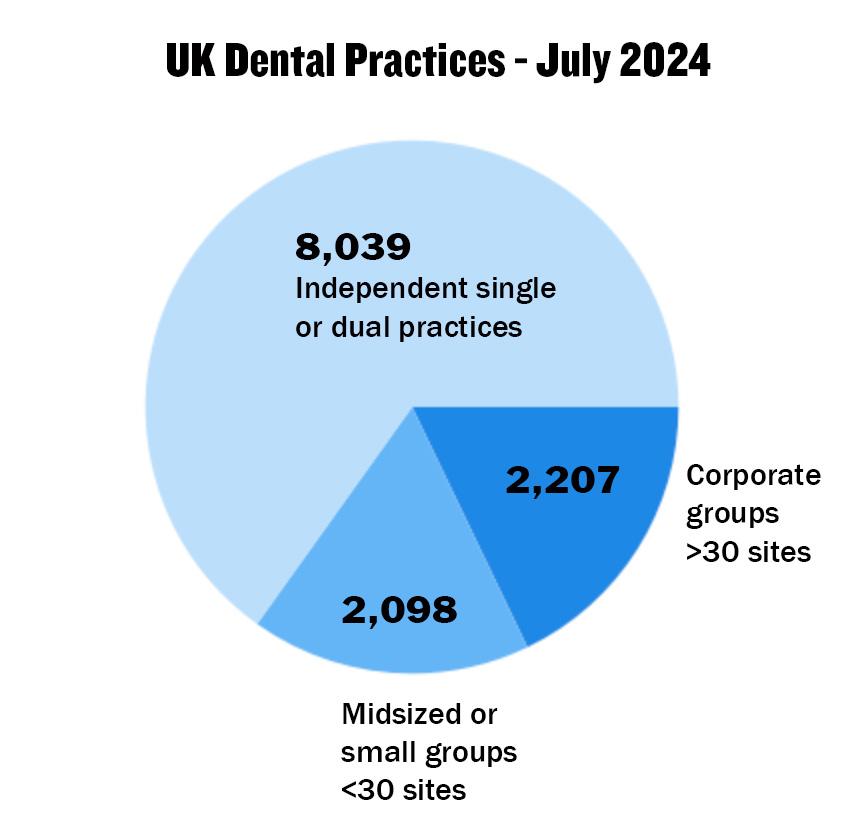

There are currently about 12,300 dental firms in the UK, represented by 8000 independent single/dual practices, 2,100 owned by small groups, and 2,200 owned by corporate and larger (including private equity-backed) groups.

The top corporate players are MyDentist with 532, BUPA with 389, PortmanDentex with 380 and Rodericks Dental Partners with 226 practices. Together, the top four own 12.4% of all practices.

Many of the larger corporate owners are controlled or backed by private equity, which has a strong interest in the dentistry sector, due to several factors:

- Fragmented market offering consolidation opportunities

- Robust cash flow characteristics

- Multiple avenues for value creation

- Potential for technological advancement and operational improvement

Recent significant private equity activity includes Nordic Capital's acquisition of Dentex, and the catapulting of Rodericks into the ‘top four’ in 2023 as a result of the merger with Dental Partners, following Capvest's acquisition of stakes in both companies in 2021.

Activity at this level reflects continued institutional investor confidence in the sector. PE-backed groups are increasingly focusing on building out specialist capabilities and developing multi-site operations with sophisticated central support functions.

Although still a dominant force, in aggregate, corporate groups recorded a significant decrease in acquisition volume in 2023/24, as higher operational costs, high interest rates and workforce challenges reduced optimism. On an international level, there are reports of some private equity companies having to hold on to their dental portfolios for extended periods of time, as they struggle to retain partner and junior level dentists due to changes in compensation structure that follow a deal.

The bigger dental corporates in the UK are very profitable. The largest operator, MyDentist, owned by PE company Turnstone equityco 1 Ltd, posted £80 million net operating profit before tax on a £536 million turnover in the year to 31 March 2024, with a gross margin of over 50 per cent. In line with where most dental corporates are headed, MyDentist's private revenue has grown 160% while its NHS revenue is down 16% over the past five years.

Nevertheless, unlike the US, the UK dental industry remains fragmented and predominantly independently owned.

Over the past eighteen months, it is the independent operators that have driven acquisition numbers, recording a 150% increase in total acquisition volumes in the second half of 2023 as compared with the first half. Figures for 2024, when released, are expected to show this trend continuing.

In the dental industry, many of the smaller practices, particularly the younger ones, are quite adaptive and innovative. These small, agile operators are up with technology trends (as are the larger operators); in the main they constantly strive to improve customer service, and are drawn to acquisition as a key strategy to increase revenue. Importantly, they respond well to market needs and are in tune with their local communities.

Let’s dive into some market numbers.

According to Mordor Intelligence the UK dental industry is worth £1.3 billion a year and forecast to grow another £100 million annually for the next five years.Amazingly, three out of five buyers of dental practices are independent acquirers and 70% of all buyers live in the same area (70km radius).

At any one time about 4 per cent of practices are actively up for sale, almost always via a broker.

In June 2024, there were just under 500 practices on the market, and over the course of a year, around 700 practices come to market.

There were 510 practices sold in 2023, suggesting about 70 - 75% of practices put on the market ended up selling. The average dental valuation in 2023 was £1.32 million, showing a continued upward trend since 2021 with the average in 2022 at £1.18 million. The average time to exchange was 200 days.

Demand for acquisitions in the sector has been running high, with on average four offers submitted on average per sale, compared to two offers per sale in 2022. Not surprisingly, most of those making the offers are the small independents (61%).

This shows the resilience of the sector in more challenging economic circumstances. Strong demand from potential purchasers and augmented private turnover across many units have driven profitability and, consequently, value, despite a slight softening in multiples as the impact of higher inflation and rising interest rates are felt across the sector.

In a recent Christie & Co survey of 35,000 dental professionals, over half planned to either buy or sell a practice in the next 3 years.

Another factor that plays a part in the attractiveness of M&A in the sector has been the relatively positive bank financing environment, with a range of lenders actively looking to support the dental market with their growth and acquisition plans.

We are aware of a first-time buyer in Scotland presenting a solid forecast for a £275,000 leasehold purchase of a practice, to receive a 100% finance offer from the lender.

There is also the case of two experienced dentists in the South East seeking to acquire their first practice - well established but underperforming. Not only were they given 100% acquisition finance, but the lender also covered the cost of equipment to launch new services.

What are the key growth drivers in the UK dental industry?

The dental sector's growth continues to be driven by multiple factors. One significant driver is the ongoing shift towards private dentistry, accelerated by the challenges facing NHS dental services. With approximately 12 million people in the UK unable to access NHS dental care (more than one in four adults), patients with money are turning to private practices. This has resulted in a significant move away from acquisitions of NHS-only practices amongst corporate buyers. Unfortunately this only makes the current NHS dentistry crisis worse - already, 90% of dental practices are no longer accepting new NHS adult patients.

The cosmetic and aesthetic dentistry segment continues to flourish, driven by social media influences and growing consumer focus on appearance. This trend has been particularly evident in the demand for treatments such as clear aligners, veneers, and whitening procedures.

Another key factor is the increasing integration of technology in dental practices. Digital dentistry, including CAD/CAM technology, 3D printing, and artificial intelligence-driven diagnostics, is becoming more prevalent, enabling practices to offer more efficient and sophisticated treatments while potentially improving profitability. And lastly, net migration growth, which is running at around 500,000 a year, is adding to an ageing incumbent population.

Prices & EBITDA multiples

Sale prices of dental practices dropped 6.4% in 2023, after 8.6% and 2.2% rises in 2021 and 2022 respectively. (see our last 2022 M&A Snapshot of the UK Dental Industry)

A fair assessment of this is that an aggressive post-covid growth has been tempered with a healthy recalibration and a return to stability. Inflation and energy costs are also factors. Price are expected to increase again over the course of 2025. Practice values are expected to remain robust, supported by strong buyer demand and the sector's defensive characteristics. The trend towards private dentistry is likely to continue, creating opportunities for operators to expand their service offerings and increase revenue per patient.

| UK Dentist EBITDA Multiples - Year to June 2024 | ||||

|---|---|---|---|---|

| Category | Owner-operated | Range | Associate-led | Range |

| Private (90%+) | 3.3 | 1.7 - 4.8 | 8.1 | 6.7 - 8.8 |

| Mixed, Private-led (50-90%) | 2.9 | 2.0 - 3.7 | 7.9 | 6.4 - 9.3 |

| Mixed, NHS-led (50-90%) | 3.7 | 1.9 - 5.6 | 7.6 | 6.5 - 9.6 |

| NHS (90%+) | 3.7 | 1.5 - 4.4 | 7.5 | 6.2 - 11.2 |

| Average / Range | 3.4 | 1.5 - 5.6 | 7.7 | 6.2 - 11.2 |

The sizeable difference in EBITDA multiples between owner-operated practices and associate-led practices is explained by the fact that the working principals are not deducting their own cost in the profit and loss accounts. This will necessarily mean a higher EBITDA percentage and consequently a lower valuation multiple.

Associate-led practices are those where there is no dominant working dental principal and all labour costs are accounted for in the P&L, resulting in a lower EBITDA as percentage of turnover and a higher multiple of earnings as reflected in the sale price.

The average EBITDA of associate-led dentist practice firms to mid 2024 is 7.7x, with NHS practices at around 7.5x and private practices commanding around 8.1x.

What is interesting is that 44% of all accepted offers were above the asking price, with another 30% at the asking price. This reflects the competitive market and the fact that multiple offers being made for a practice are quite common.

Example of a dental practice currently for sale on BSR

- Type of practice: Mixed NHS & Private

- Location: London

- Number of Surgeries: 3

- Turnover: £780,000

- Price: £1,050,000

- NHS contract £300,000

- EBITDA (Associate Led): £131,918

- Proven to operate with 17% profit

- EBITDA (Owner Operated): £257,418

Deal structures and deferred consideration

This section is available to BSR Members

Market Outlook

The UK dental market outlook remains positive, with several factors supporting continued M&A activity:

- Ongoing pressure on NHS services driving private sector growth

- Continuing technological advancement creating opportunities for modernisation

- Strong demographic trends supporting long-term demand

- Persistent fragmentation offering consolidation opportunities

However, the market faces some challenges, including:

- Staffing pressures and recruitment difficulties

- Rising operational costs

- Regulatory compliance requirements

- Economic uncertainty affecting consumer spending

Despite these challenges, the fundamental attractiveness of the dental sector remains strong. The combination of stable demand, multiple growth drivers, and significant consolidation potential continues to attract investors across the spectrum, from independent practitioners to institutional investors. Christie & Co have indicated that their deal pipelines are looking very full this year, indicating reinvigorated confidence in the market and an expected uptick in expansionary investments.

The ongoing evolution of the dental market, particularly the shift towards private care and the integration of new technologies, suggests that M&A activity will remain a key feature of the sector in the coming years, as operators seek to build scale and capability to meet changing patient needs and market demands.

By Chris St Cartmail, Business Sale Report director and Senior Exit Planning Advisor.

If you want to increase the value of your practice, get it 'exit-ready', or you are building/selling a group of dental practices, our experienced deal team and exit advisers may be able to help.

Check our live current listing of UK medical businesses for sale.

Sources:

Christie & Co

Henry Schein Dental Practice Sales

Office for National Statistics. (2023). "UK Population Projections."

https://dentistry.co.uk/2024/11/27/dental-recovery-plan-what-has-it-achieved-so-far/

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(24)00352-0/abstract https://pitchbook.com/news/articles/private-equity-dental-exits

Mordor Intelligence - UK dental services market

Share this article

Latest Businesses for Sale

Access Equipment and Material Handling

Scotland, UK

An opportunity exists to purchase the entire trading businesses and assets of an independent provider of powered access equipment hire and material handling equipment hire, the Companies specialise in the short term hire of Access Equipment, Forklift...

Haulage Company

South East, UK

An opportunity exists to purchase the business and assets of a haulage subcontractor specialising in the movement of chilled fruit and vegetable products. The company typically collects loads from the Port of Dover and undertakes UK deliveries on beh...

Engineering Solutions

Norfolk, East of England, UK

A profitable and well-established engineering business dedicated to delivering exceptional precision parts with unparalleled quality. Specialising in complex, high-tolerance components, this company caters to a wide range of industries, including las...

Search Insights

Latest Insights

Want access to the latest businesses for sale?

Business Sale Report is your complete solution to finding great acquisition opportunities.

Join today to receive:

- Comprehensive range of businesses for sale

- Make direct contact with business sellers or their intermediaries

- Access to all UK administrations, liquidations and winding-up petitions

- Daily email alerts for the latest businesses for sale & distressed notifications

- Business Sale Report publication posted to you every month

- Advertise your acquisition requirements on our "business wanted" section

All this and much more, including the latest M&A news and exclusive resources